Credit Score Union Subscription: A Smart Financial Move

Delving much deeper into the details of debt unions and their distinct approach to banking unveils a world where members are not simply clients yet indispensable parts of a community-focused economic establishment. The choice to become a credit history union participant might potentially reshape your financial landscape in ways you never assumed possible.

Advantages of Cooperative Credit Union Membership

Credit report union subscription offers a variety of economic advantages that can benefit people and family members seeking stability and growth in their economic lives. One vital benefit is personalized customer solution. Cooperative credit union are recognized for their member-focused method, offering a more individualized experience compared to conventional financial institutions. Members commonly have straight access to decision-makers, making it much easier to go over economic requirements and goals. Additionally, credit history unions generally use reduced costs and much better passion prices on interest-bearing accounts and financings contrasted to big banks. This can result in considerable expense financial savings over time for participants.

Members typically feel a more powerful connection to their credit scores union, knowing that their monetary institution is owned and run by its members. Many credit unions provide monetary education resources and workshops to aid participants improve their monetary literacy and make notified choices.

Affordable Passion Rates

In the realm of economic solutions, one remarkable element that differentiates credit score unions is their capacity to use affordable rate of interest prices to their participants. Unlike typical financial institutions, credit report unions are not-for-profit organizations had by their participants, permitting them to prioritize the monetary wellness of their participants by supplying even more desirable rate of interest prices on financial savings accounts, fundings, and various other financial products.

Lower Fees and Prices

Participants of credit rating unions profit from decreased fees and prices contrasted to those linked with traditional financial institutions. Credit unions are not-for-profit organizations, which enables them to focus on giving budget-friendly monetary solutions to their like it members.

In addition to reduced account charges, lending institution commonly offer competitive rate of interest on lendings and credit score cards. This can cause considerable financial savings for members compared to obtaining from a conventional financial institution. Cooperative credit union also tend to have lower over-limit costs Web Site and minimum balance demands, better reducing the monetary worry on their participants.

Individualized Client Service

With a focus on structure solid partnerships and understanding specific needs, lending institution master giving customized customer care to their participants. Unlike traditional banks, lending institution prioritize member complete satisfaction and commitment over earnings. This member-centric technique allows lending institution to customize their solutions to meet the particular needs of each individual.

One of the essential advantages of personalized client service at credit history unions is the capacity to establish a much deeper understanding of each member's economic goals and challenges. By cultivating open communication and trust, credit union reps can use tailored advice and options that are truly in the very best passion of the member.

Additionally, lending institution frequently have an even more intimate setting, which enables for even more individualized interactions between staff and members. This personalized touch develops a sense of belonging and area, making members really feel valued and appreciated.

Basically, the individualized customer care used by lending institution goes beyond just deals; it incorporates Going Here building durable relationships based on trust fund, understanding, and an authentic commitment to assisting participants achieve their financial ambitions. - hybrid line of credit

Community-Focused Efforts

Credit score unions extend their dedication to member fulfillment by actively engaging in community-focused efforts that intend to profit both their members and the bigger culture. By offering workshops, seminars, and resources on topics such as budgeting, saving, and investing, credit unions empower individuals to make sound economic choices that can positively impact their lives.

Moreover, cooperative credit union often collaborate with neighborhood philanthropic organizations to sustain various causes, such as affordable housing campaigns, young people education programs, and environmental conservation initiatives. Via these collaborations, credit history unions not only add to the improvement of society however also reinforce their connections with area participants. By purchasing the wellness of their communities, lending institution display their worths and dedication to making a significant distinction beyond their financial services.

Final Thought

To conclude, cooperative credit union subscription offers people a clever economic selection with competitive rate of interest, reduced fees, individualized customer care, and community-focused campaigns. wyoming credit union. By signing up with a credit score union, members can gain from a more intimate banking experience that prioritizes their monetary health and supports the areas they offer. In today's economic landscape, lending institution offer an one-of-a-kind and cost-efficient choice to standard banks, making them a wise decision for those seeking a more personalized and economical financial experience

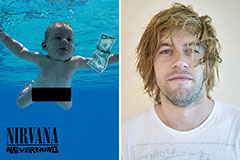

Spencer Elden Then & Now!

Spencer Elden Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Shane West Then & Now!

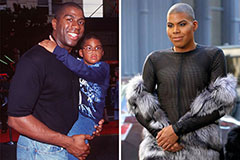

Shane West Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!